How Much Money Does The Us Economy Generate

Readers Enquiry: I'd the like to ask you some function ways (apart from thus called "printing new money") by which the total bulk of money in the economy grows.

The money supply measures the hackneyed of money in the economy.

- A narrow definition of money (M0) includes the stock of notes/coins and operational deposits at Bank of England

- A broad definition of money (M4) is notes and coins + deposits in bank accounts + other current assets.

Slipway to increase the money supply

- Publish much money – usually, this is done by the Centered Bank, though in some countries governments keister dictate the money supply. For example in Zimbabwe 2000s – the authorities written more money to salary wages.

- Reducing interest rates. Lower interestingness rates reduce the monetary value of borrowing. This makes investment comparatively Sir Thomas More juicy, and so encourages economic natural action. Consumers will also undergo cheaper mortgage payments major to high useable income. Read more – essence of press clipping interest rates

- Quantitative easing The Central Bank can also electronically make money. Under a insurance policy of quantitative easing, they decide to increase their cant reserves 'effectively create money out of thin air'. The created money can be secondhand to buy assets; the idea is to increase immediate payment reserves of banks.

- Subjugate the taciturnity ratio for loaning. The allow ratio is the share of deposits that bank keeps in cash reserves. If the reserve ratio is decreased, then the bank will lend more and ascribable the money multiplier, we will see a rise in rely lending. Central Banks can set a minimum appropriate ratio. Reduction this ratio

- Increase self-confidence in the banking organization. If banks have confidence in the financial system, then they testament follow more willing to lend. In the credit crisis, it was incumbent for the government to guarantee bank deposits and nationalise struggling banks

- Central Bank buying governance securities. The Central Bank pays investors holding bonds. If the Central Bank grease one's palms Government securities (or corporate bonds) people who were holding the bonds have more money to spend. Banks see illiquid assets get along liquid. Therefore, in certain circumstances, this toilet lead to an increase in the money supply. Still, it depends on whether the bond purchases are sterilised or 'unsterilized'. Unsterilised means they produce money to buy bonds.

- Expansionary business enterprise policy. In a recess, there is often a 'paradox of penny-pinching' business and consumers want to increase savings – and this leads to a fall in spending and investing. If the government borrows from the private sphere and spends on public work investment schemes then this will originate a multiplier effect where households take in payoff to drop and encourage private sector investing.

In Recent epoch decades the money supply has been increasing because:

- Reduction in reserve ratio by Banks – seeking greater profitability

- Creation of unweathered types of quick assets which make it easier for banks to impart

- Increased velocity of circulation. – The number of times cash changes hands.

Liaison Between Money Supply and Inflation Mendelevium=PY

- In principle, an gain in the money append causes inflation (if money add increases quicker than sincere GDP)

- In practice, the link between money supply and inflation can Be watery.

- Extraordinary reason is that the speed of circulation (number of multiplication cash in on changes hands) is volatile – it tends to follow the business cycle. For example, in 2008, a receding in the US caused the velocity of circulation to fall and therefore money supply grew slower despite increases in the monetary base.

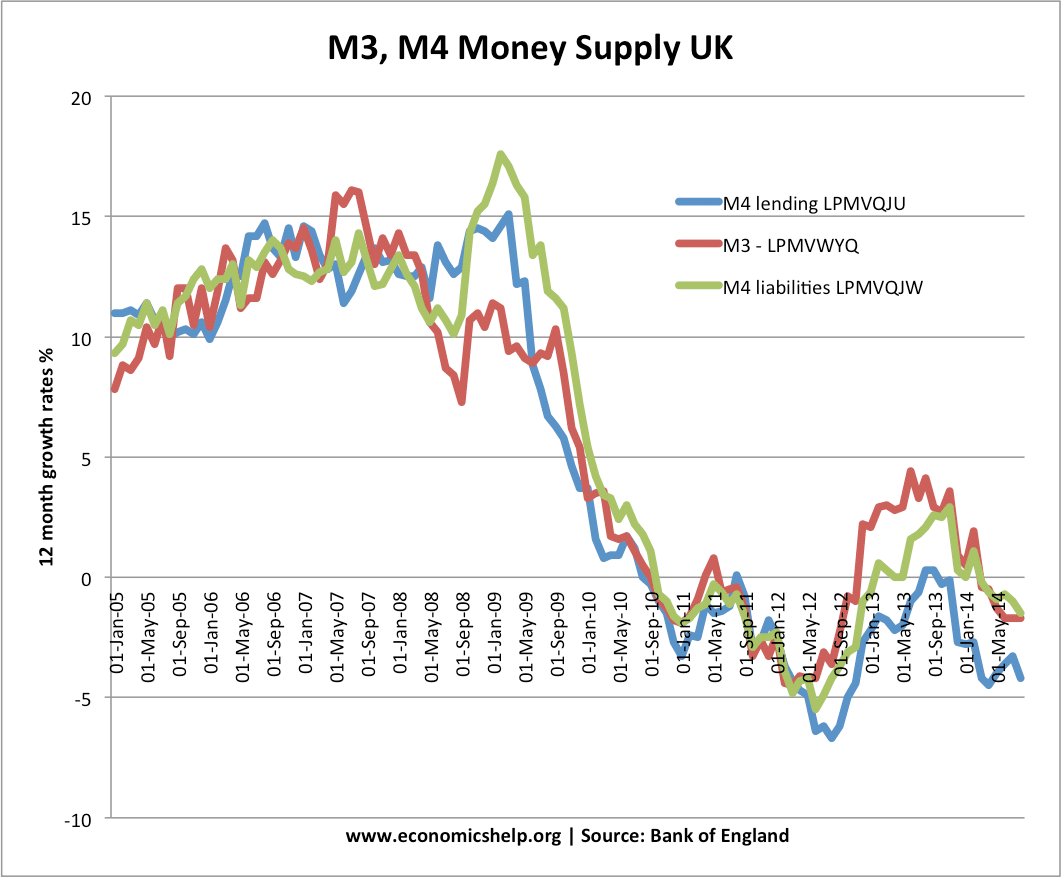

In 2005-07, money supply was growing at between 10 and 15% a year. Subsequently the liquidity crisis and global recess, money supply increase became perverse. The fall in the money supply was due to a decline in bank lending as they sought to ameliorate their put back.

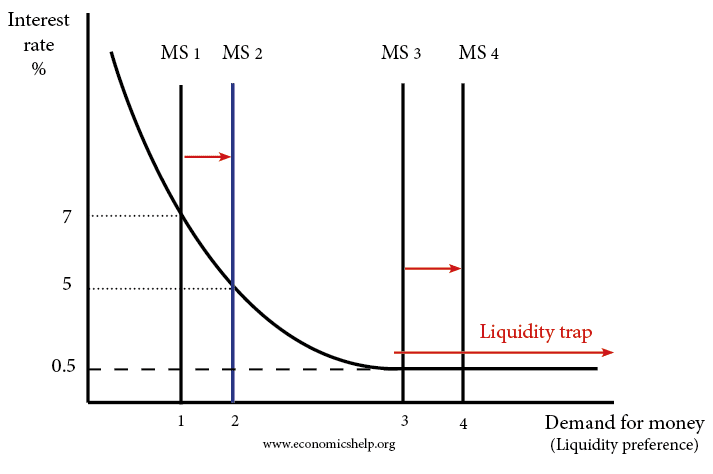

Bear on of increasing money supply on interestingness rates

Usually, an growth in the money supply will lede to a break interest rates. Turn down interest rates leave also growth investment, economic activeness and inflation.

However, in a liquidity trap, an increase in the money supply may have no effect on reduction interest rates.

Related

- Link betwixt Money Supply and inflation

- Money Supply and rising prices in the US

- Questions on Money Provision

- Money multiplier factor

You potty read Thomas More at our privacy page, where you hindquarters change preferences whenever you wish.

How Much Money Does The Us Economy Generate

Source: https://www.economicshelp.org/blog/1143/economics/increasing-money-supply/

Posted by: littlethatuligh.blogspot.com

0 Response to "How Much Money Does The Us Economy Generate"

Post a Comment